Stock splits and bonus issues are two of the most popular corporate actions in Indian markets, often generating excitement among retail investors. But what exactly happens to the share price when these events are announced? Do they create real value, or is it just a psychological boost? Let’s explore the facts, figures, and real-world impact using the top 10 split and bonus events of 2025.

What Are Stock Splits and Bonus Issues?

Stock Split

A stock split divides existing shares into more shares, reducing the face value proportionally. For example, a 1:2 split means each ₹10 share becomes two ₹5 shares. The total market capitalization remains unchanged, but the number of shares increases.

Bonus Issue

A bonus issue gives free shares to existing shareholders. For example, a 1:1 bonus means one extra share for every share held. Again, market cap stays the same, but the number of shares increases.

Does Price Rise When Announced?

Short-Term Impact: Yes, Usually

Announcement Effect: Most stocks see a positive price reaction on the announcement day. This is because splits and bonuses signal management confidence and attract retail participation.

Example: Bajaj Finance announced a 1:2 split and 4:1 bonus in April 2025. The stock surged 5% on announcement day and continued to rise in the following weeks.

Ex-Date Impact: Technical Adjustment

On the ex-date, the price adjusts proportionally. For a 1:2 split, the price halves. For a 1:1 bonus, it also halves.

Example: Adani Power announced a 1:5 split in August 2025. The stock price dropped 80% on the ex-date, but the fundamental value was unchanged.

Post-Event Impact: Liquidity and Participation

Liquidity: Splits and bonuses increase the number of shares, improving liquidity and trading volumes.

Retail Participation: Lower face value makes shares more accessible to retail investors, often boosting trading activity.

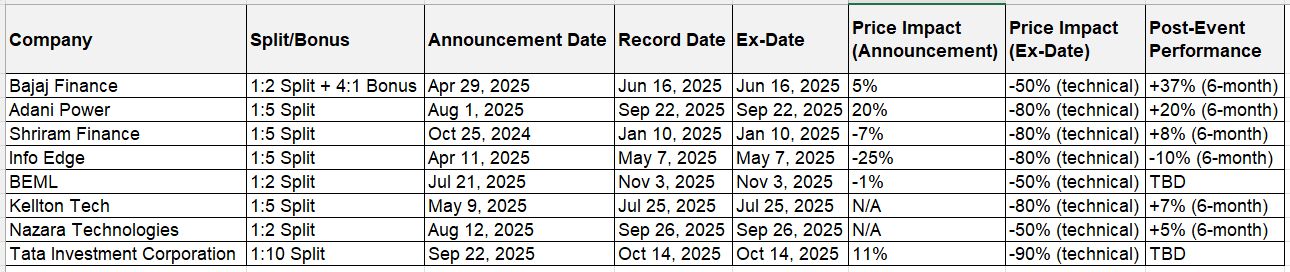

A Few examples of Stock Splits and Bonus Events in 2025: Impact Analysis

Interesting to check the charts for these stocks specially between announcement date, record date and the date the shares were credited. These are not all the splits and bonus which were done in 2025. A lot of other names had a positive impact.

Detailed Impact on Price –

Announcement Date

- Bajaj Finance: +5% on announcement, strong positive sentiment.

- Adani Power: +20% on announcement, locked in upper circuit.

- Info Edge: -25% on announcement, sector weakness dominated.

Ex-Date

All stocks saw a technical price adjustment proportional to the split/bonus ratio.

- Bajaj Finance: -50% (1:2 split), -50% (4:1 bonus).

- Adani Power: -80% (1:5 split).

- Shriram Finance: -80% (1:5 split).

- Info Edge: -80% (1:5 split).

Post-Event

- Bajaj Finance: +37% in 6 months.

- Adani Power: +20% in 6 months.

- Shriram Finance: +8% in 6 months.

- Info Edge: -10% in 6 months.

Key Takeaways

Announcement Effect: Positive for strong fundamentals, negative for weak fundamentals.

Ex-Date Impact: Technical price adjustment, no fundamental change.

Post-Event: Liquidity and participation improve, but long-term performance depends on fundamentals.

Retail Impact: Lower face value makes shares more accessible, boosting trading volumes.

The actual split/bonus is value-neutral, but the announcement itself is a bullish catalyst. That’s why you often see the stock run up before the record date and sometimes correct afterward.

It’s keep a track of these events, keep a check of the stocks which are very priced in terms of price and not valuations. Good to trade in stocks those for short term gain. However this is not always guaranteed. Always keep valuations in check.

I have created a ChatGPT prompt to keep a track of these stocks. Comment “Bonus Split Prompt” below and I will send you the prompt via email.

Bonus Split Prompt

Prompt shared on email